Job Market Paper

HEGEMONIC cOMPETITION WITH cARROTS AND sTICKS

Timothy Meyer and Nicolas Wesseler

Link: PDF

Abstract

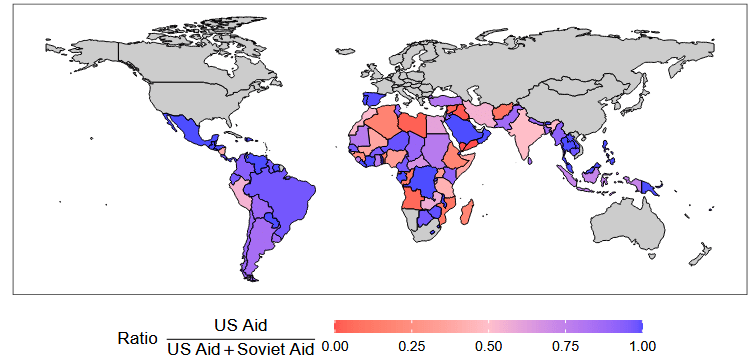

Hegemonic powers use economic tools to influence the geopolitical alignment of third countries. We develop a model in which two competing hegemons use direct payments (carrots) and economic threats (sticks) to influence third countries. Guided by the model, we measure carrots and sticks using historical data from the Cold War. We use our measures to empirically estimate the effects of carrots and sticks on geopolitical alignment. These tools create political alignment, but are expensive. We combine the model with the empirical estimates to compute the geopolitical return on foreign aid and evaluate the consequences of the USAID shutdown for the modern U.S–China competition.

Publications

Asset Price Changes, External Wealth and Global Welfare

Timothy Meyer

Journal of International Economics, 2025

Best Paper Award, 23rd RIEF Doctoral Meeting

Links: Published Version, PDF

Abstract

U.S. equity outperformance and sustained dollar appreciation have led to large valuation gains for the rest of the world on the U.S. external position. I construct their global distribution, carefully accounting for the role of tax havens. Valuation gains are concentrated and large in developed countries, while developing countries have been mostly bypassed. To assess the welfare implications of these capital gains, I adopt a sufficient statistics approach. In contrast to the large wealth changes, most countries so far did not benefit much in welfare terms. This is because they did not rebalance their portfolios and realize their gains. In contrast, direct welfare effects from the dollar appreciation on import and export prices are an order of magnitude larger.

Working Papers

The Wealth of Generations

Luis Bauluz and Timothy Meyer

Revise and resubmit, Review of Economic Studies

Link: PDF

Abstract

This paper provides the first systematic evidence on life-cycle wealth accumulation across birth cohorts. Using historical U.S. microdata dating back to 1960, we document two shifts in life-cycle dynamics beginning in the 1980s. Relative to their lifetime incomes, recent cohorts accumulate substantially more wealth. They also save more during middle age and have become large dissavers in old age, accounting for the stagnation of the U.S. saving rate. We link this transformation to the post-1980s boom in asset prices and examine its implications for age-wealth inequality and intergenerational welfare. A stylized OLG model reconciles our cohort-level findings with macroeconomic trends.

Media Coverage: The Economist, Bloomberg, El Confidencial

THE Great Leveler according to Hank

Ralph Luetticke, Timothy Meyer, Gernot Müller and Moritz Schularick

Link: PDF

Abstract

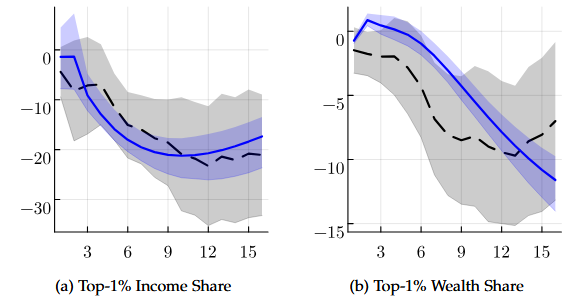

Using historical income and wealth data, we show that war reduces inequality: the top-1% income share falls by 20% and the top-1% wealth share by 10%. We measure three key drivers of inequality—capital destruction, taxation, and inflation—in the data and quantify their role with a Heterogeneous Agent New Keynesian (HANK) model. Destruction depresses profits and thus top incomes. Taxation primarily influences wealth dynamics, while inflation has little effect on top shares, but reduces indebtedness among poorer households. We validate our findings using new data on inequality across German towns in World War 2 and cross-country data on profits.

THE eMERGING mARKET gREAT mODERATION

Alfredo Mendoza Fernandez and Timothy Meyer

Link: PDF

Abstract

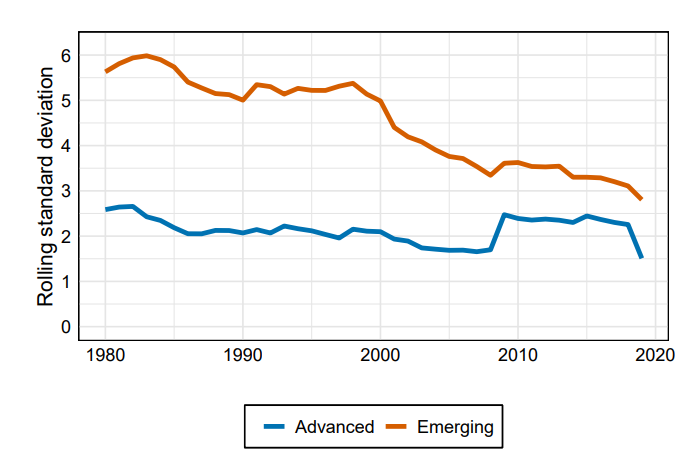

We document a Great Moderation in emerging markets, a dramatic fall in aggregate macroeconomic volatility by about 40%, without changes in other distinctive characteristics of emerging market business cycles. Using a novel methodology, we link the moderation to canonical emerging market business cycle theories. Consistent with those theories, the contribution of fluctuations in the growth trend is substantial, and has not diminished. The moderation resulted in important welfare gains in emerging economies and stems from a reduction in country-specific volatility, which can be linked to shifts in monetary policy.